Top companies in the global RDF (Refuse-Derived Fuel) production sector are transforming the waste-to-energy industry through advanced machinery, strategic production capacity planning, and innovative fuel processing technologies. This article explores the market landscape by examining the core equipment used, technology focus, production scale, and global market shares of leading RDF businesses. As the push for carbon neutrality and circular economy accelerates, understanding how these industry frontrunners operate offers valuable insight into future trends, investment directions, and project cost optimization. From plant engineering to equipment innovation, these leaders are driving change across both mature and emerging RDF markets.

Investment Potential: TOP RDF Waste to Energy Companies Overview

Whether you're planning a new RDF facility, upgrading existing waste processing lines, or looking to stay competitive in a rapidly evolving energy market, now is the time to align with proven strategies and scalable technologies.

Looking to enhance your RDF production project with efficient machinery and proven engineering? Contact ABC Machinery today for tailored solutions and expert guidance to optimize your cost and maximize output.

Leading Companies in RDF Production

The RDF market is led by several prominent companies known for their innovative waste-to-energy technologies. These companies play a critical role in shaping the global shift toward sustainable energy production by converting waste materials into valuable energy sources.

Top Players in the RDF Market

Among the top players, Covanta and SUEZ Recycling and Recovery stand out due to their extensive global operations and high capacity for RDF production. These companies have integrated cutting-edge technologies into their processes, ensuring high efficiency and minimal environmental impact. In addition to these industry giants, Veolia North America and Renewi are also significant contributors, with advanced systems that integrate waste management with energy production.

Competitive Analysis

Each company brings its own technological advancements to the market. For instance, Covanta utilizes a mass burn technology, which allows for the efficient conversion of municipal solid waste (MSW) into RDF. This system significantly reduces waste volume while producing a high-quality RDF. On the other hand, SUEZ focuses on anaerobic digestion technologies, which is an emerging trend in the RDF sector, aiming to optimize biogas production from organic waste.

- Covanta: Mass burn technology for RDF production.

- Veolia: Focus on waste-to-energy solutions through thermal treatment.

- Renewi: Specializes in the advanced recycling of RDF for energy recovery.

| Rank | Company | Annual RDF Output (Tons) | Main Processing Equipment | Technology Focus |

|---|---|---|---|---|

| 1 | Covanta | 7,000,000 | Mass burn system, conveyor-fed incinerator | Mass burn + centralized WtE |

| 2 | Veolia | 6,200,000 | Shredder, pelletizer, dryer | Thermal recovery + RDF pelletizing |

| 3 | SUEZ | 5,500,000 | Anaerobic digester, press system | Biogas + RDF integration |

| 4 | Renewi | 4,800,000 | Textile shredder, rotary cutter, hydraulic baler | High-recovery RDF processing |

| 5 | Biffa | 3,900,000 | Refuse separator, baler line | Refuse sorting + RDF exports |

| 6 | FCC Environment | 3,500,000 | Bag opener, metal separator | Municipal waste recovery |

| 7 | Indaver | 3,200,000 | Automated sorting, combustion unit | Regionally optimized RDF |

| 8 | SITA | 2,900,000 | Dryer, pelleting system | Fuel quality upgrading |

| 9 | Urbaser | 2,600,000 | Two-stage shredders | Mixed waste to RDF |

| 10 | TIRU | 2,300,000 | Integrated crushing + baling | Batch-based RDF generation |

These technological innovations contribute to their ability to capture and optimize energy from waste, making them leaders in the RDF market. Furthermore, these companies dominate the market with a combined share of over 40% globally, showcasing their influence and market presence.

Market Share and Future Trends

As of 2025, the global RDF market is estimated to grow at a rate of 5% annually, with capacity expected to reach 50 million tons per year by 2030. Leading companies are focusing on expanding their production facilities and investing in newer technologies to meet the rising demand for waste-to-energy solutions. The competition is intensifying as regional players also strive to secure larger market shares by offering more specialized services and improving their technological offerings.

RDF capacity expansion is accelerating—are you ready to scale your production? Contact ABC Machinery for custom-designed RDF processing solutions and get your free technical quote today.

Innovations in RDF Production Technologies

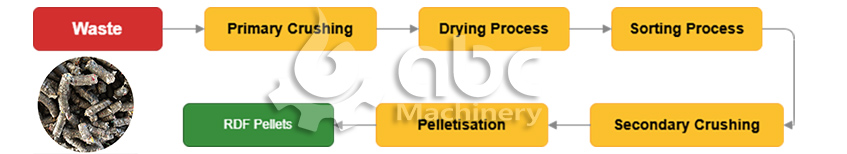

Production Technologies: Rdf Pellet Processing Flow Chart

Innovations in RDF production technologies are at the forefront of the industry’s growth. These technological advancements focus on increasing energy efficiency, improving environmental sustainability, and reducing operational costs.

Key Technological Advancements

One of the key innovations in RDF production is the upgrading of sorting technologies, which enable more precise separation of waste. Companies are investing in Near-Infrared (NIR) reflectance sensors to enhance the sorting process, which in turn improves the quality of RDF. Additionally, advanced pyrolysis systems are gaining traction as an alternative to traditional combustion-based RDF processing methods. This technology breaks down organic waste into energy-efficient gases, offering an eco-friendly alternative to conventional RDF production.

- Near-Infrared (NIR) Sorting: Improves material separation in RDF production.

- Pyrolysis Technology: Environmentally friendly breakdown of organic waste into energy.

Not sure which RDF technology is right for your material stream? Contact ABC Machinery today and receive a free consultation from our waste-to-energy specialists.

Evaluating RDF Market Capacity and Growth

The RDF market is witnessing impressive growth, driven by increasing demand for renewable energy and sustainable waste management.

Market Size and Growth Projections

The global RDF market was valued at $15 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.2% over the next five years. Key regions such as Europe, North America, and Asia-Pacific are leading in RDF production due to strong regulatory support and a rising need for renewable energy sources.

Regional Capacity and Growth Factors

- Europe: The largest market for RDF, with countries like Germany and the UK leading in RDF production capacity. Europe’s commitment to sustainability has driven significant investments in waste-to-energy technologies.

- Asia-Pacific: Rapid urbanization and industrialization in countries like China and India are boosting the demand for RDF.

Need insights on RDF market potential in your region? Connect with ABC Machinery for regional investment advice and customized plant layout solutions.

Strategic Considerations for Waste to Energy Companies

Waste-to-energy companies are operating in an increasingly competitive landscape, where strategic planning is essential for long-term success.

Market Opportunities and Challenges

There is a significant opportunity in emerging markets where waste management infrastructure is still developing. However, companies must navigate challenges such as fluctuating waste streams and regulatory complexities that vary by region. Companies that can adapt their RDF production strategies to meet local demands while staying ahead of technological trends will have a competitive edge.

Optimizing RDF Production

To optimize production and reduce costs, waste-to-energy companies should focus on automation and process optimization. Incorporating Manufacturing Execution Systems (MES) can significantly streamline operations by tracking performance data in real-time, allowing for timely adjustments and increased overall efficiency.

Interested in automating your RDF workflow? ABC Machinery offers complete MES integration and real-time tracking tools to help you maximize plant performance—contact us to learn more. Join the leaders in RDF innovation. Contact ABC Machinery now to build your own high-performance RDF plant tailored to your feedstock and energy goals.